As published in July`s edition of Currency News, Giesecke+Devrient (G+D) held its Currency Technology Symposium 2023 that month in Munich, the main themes of which were resilience, hyper-efficiency and sustainability within the cash cycle, and the role of cash in today´s world.

In the July edition, we reviewed the company’s activities on sustainability – including its new Banknote Fiber Extraction (FBE) technology for repurposing banknote waste and the Green LongLife™ banknote. Last month we covered the social value of cash. This month we turn our attention to resilience and efficiency, a topic that was also covered in a webinar hosted by G+D for IACA members entitled ‘Cash Resilience in a Time of Crisis’ at the end of September.

According to G+D, an important part of resilience is having in place strong technology cash infrastructure, along with appropriate redundancy and back-up for the unexpected. At the same time the cost of cash must be kept on a level so that commercial banks and merchants choose to use it. Digitisation, standardisation and automation in cash processing are key to delivering this.

G+D uses the term ‘hyper-efficiency’ to describe the combination and integration of these activities to optimise the cash cycle.

When software is done well, it drives efficiency and enables innovation. It should make life easier, quicker and cheaper. Too often though, software is implemented in a fragmented, disjointed and opportunistic fashion. To succeed it needs to work with processes, regulations and policies, and be seamlessly integrated into the backend systems of the cash cycle players.

G+D’s cash management software, Compass, has modules that cover forecasting, cash centre management, systems intelligence and transportation. It is being developed into three levels of product:

Cash Centre Starter, which covers inbound and outbound cash movements

Cash Centre Premium, which integrates with all Compass modules, providing full cash centre management incl. ATM replenishments

Cash Centre Enterprise, which is fully customisable and intended for larger cash centres.

Compass is being improved across all the different modules.

AI is already in our daily lives with voice assistance (eg. Siri) and chatbots. Netflix recommended content is AI driven and a third of purchases on Amazon come from their recommendations generated by AI analysis. Using AI in cash management should allow smoother handling of big data, self-learning and easier detection of seasonality and trends, delivering:

More accurate prediction of cash trends down to ATM cassette level

Optimisation of orders reducing costs (cost of cash in network, service costs, grouping)

Achievement of service level agreements (service windows, risk buffers, maximum order levels).

Order placing and reports using ChatGPT is the future and should make working with the software more intuitive.

Cloud usage is growing fast around the world. G+D offers Compass Cloud, which offers customers software that is fully managed, available and secure. In addition, it is scalable, updates and upgrades are easy, and it is environmentally friendly. The future of software will be built on increased connectivity and more AI.

Transport is being upgraded to include contractual agreements, en route execution, to plan master routes and daily routes, allow flexible rescheduling, provide mobile support to crews, oversee operations at a high level and to fully track package life cycles.

The aim is to be easy to use, give better control and be secure. Compass Transport will also smoothly interact with the cash centre management software, easing the interface between the ordering and delivery.

Key steps towards more efficiency are to streamline, simplify and eliminate process steps. Within these steps, standardisation offers real benefits. An example is the NotaTray®. Although a simple idea, to be used successfully central banks, cash management companies and cash in transit companies need to be involved in its introduction.

If notes are packed into a NotaTray and are then used to fill an ATM cassette, because the notes in the NotaTray are not banded and have been counted, they are ready to be picked and packed directly without bands or straps having to be removed and without being recounted. In a cash centre packing 420 ATM trays in a seven hour shift, the number of people required will go down from three to two people.

Additionally, if loose banknotes are moved in securely sealed containers and accompanied by a digital twin, commercial players as well as central banks could eliminate banding and bundling, with a huge impact on efficiency and sustainability.

A new more environmentally sustainable NotaTray is nearly ready for use. It is made with recycled mix of polymer and a modified process and will save 50% of the current CO2 footprint of the trays.

Automation on its own delivers benefits, but introducing it as part of a systemic change will make the most difference. The starting point is an analysis of the ‘as is’ position, an eco-system overview, followed by the definition of new banknote handling processes. Standardisation, particularly of the trays used and the data used, allows the definition of the optimum equipment setup and level of automation. Any change needs to consider the design of future- proof layouts with defined hardware and software plans.

The level of automation possible, or which is optimal, depends on factors such as the throughput required, the level of manual handling, operating site conditions and the space available. Storage and ergonomic policies are also key.

Mapping these factors, particularly throughput relative to the space available and throughput compared with the level of manual handling allows an assessment of whether high, medium or low levels of automation is appropriate. Digitisation allows digital twins to be created of physical stock so that it can be tracked and traced. It also provides a useful mapping tool.

There are a number of automation use cases.

Within a cash centre, Banknote Processing Systems can be loaded automatically to increase the throughput by ensuring a constant flow of cash without manual handling and fewer errors.

Furthermore, as described previously, the refill of ATM cassettes from NotaTrays with loose banknotes eliminates debanding, strap removal or recounting of packets.

As an inter-cash centre logistic element, a NotaTray eases any movements of fit notes to bank branches and of fit and unfit banknotes to central banks and back to commercials.

In many cases automation means intra-cash centre logistics which is not limited to conveyor belts but can also include rail guided vehicles, AGVs or simply choosing the right boxes. Vaults and storage systems can be (semi-) automised at all degrees, packaging starts with banding and bundling but can include even automated packaging in boxes and on pallets.

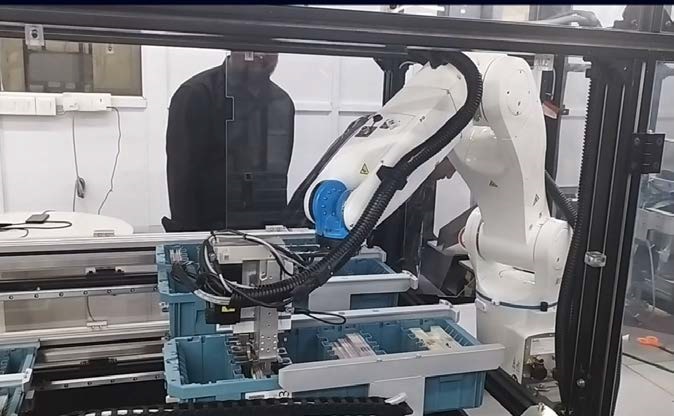

G+D demonstrated a BPS C5 with robotic tray filling. The robot bands, loads, moves and stacks the trays. It does this at a rate of 45,000 notes per hour steady state (theoretical 60,000). This is an automated solution aimed at mid-size cash centres, ie. from 300,000 to 1 million notes processed per day. At this stage this is probably of most interest to countries with labour shortages and high labour costs. It should be ready for sale in the first quarter of 2024.

In addition, a robotic loading and reject system is under development.

BPS C2 – newly updated version

BPS C5 – this now has the same infrastructure as the C2

BPS C5 – with a new bander delivery module

BPS Mevo – new design, easy to use interface, upgraded software, NotaTray filling module (see CN August 2023).

A BPS C5 robot loading NotaTrays

A BPS C5 robot loading NotaTrays

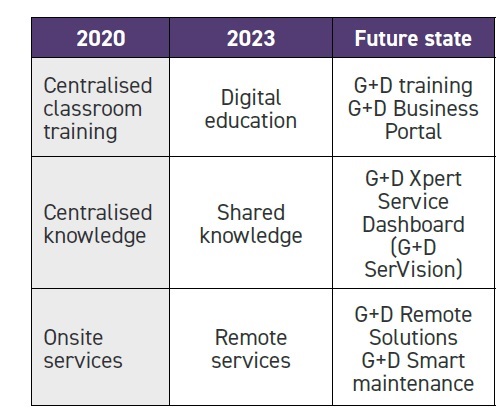

The pandemic accelerated a change in training that goes beyond just the

application of technology. There has also been a change in ethos. A combination of human expertise and digital technologies is allowing a new approach to service delivery, with an emphasis on partnership, knowledge sharing and targeted servicing of equipment.

Training efficiency is being built on digitalisation and standardisation. While G+D is maintaining its training centres in Dulles, Mexico City, Sao Paulo, London, Madrid, Munich, Dubai, Delhi, Johannesburg and Hong Kong, the plan is that its Business Portal will be used to deliver the learning management system as a self-service tool.

Technology is changing the way training and services are provided. BPS X9 training is already delivered through virtual reality as a fully immersive experience. Documentation for all machines can be accessed via a QR code that links people to videos (on YouTube), user manuals and e-learning.

SerVision is a service dashboard that complements Compass System

Intelligence. It is hosted in the cloud and is used to monitor machine health and to report service incidents. Spare parts and materials can be ordered using it. Cash centres can use their own data from non-G+D machine information to staff absences, etc. It allows one-click reporting and ad hoc and periodic reporting, eg. performance against Service Level Agreements.

G+D Remote Solutions delivers visual support (through the G+D Care centre), with video calls, and allows people to access machine error reports.

A two-year study of 75,000 services at BPS machines in nine regions found that:

43% of machine downtime events were unplanned

49% of the root cause of machine failures is due to low-grade parts

>85% downtime costs are higher than the cost of service.

The Smart Maintenance programme, which is based on G+D’s secure cloud, carries out remote machine health monitoring to allow timely interventions that avoid unplanned down time and to ensure high machine uptime.