PerceptNote® is the brainchild of two experts working in the area of banknote analysis, Jane Raymond from Secure Perception Research Ltd and Ernesto González Candela from UnderCurrency SA de CV. Each recognised the value of perception analysis for banknote design but also saw the problems and challenges of conducting perception testing with physical samples. In this article, they explain their solution.

The public’s perception of banknotes is central to banknote security. Indeed, banknotes are only secure when public users can easily authenticate them. Bearing this in mind, central banks and security feature suppliers continuously develop newer, better designs to support public perception.

But how can the industry know if innovations in public-level security features aid public perception?

Traditionally, central banks and some technical development groups have turned to ‘perception testing’ to gain objective data on the perceptual functionality of new designs and security features. Perception testing involves presenting multiple physical copies of each candidate design (and their counterfeits) to a sample of public users. Their capacity for quick accurate authentication is measured.

Such testing is expensive, time consuming, and presents a significant security risk. Moreover, traditional perception testing requires physical banknotes and counterfeits to be ‘manufactured’ or, at least, physically mocked-up.

These requirements create a dilemma for those responsible for next generation banknote design. Should decision-makers engage in costly and time-consuming perception testing to gain certainty about public perception of the final product, or should they by-pass perceptual assessment and thereby risk issuing a product that is difficult for the public to perceive?

PerceptNote® Technology solves the problem by applying predictive perception. An alternative method for assessing perceptual functionality is to engage with image analysis, artificial intelligence (AI) and cognitive science to create software that can accurately predict how people will look at and authenticate novel banknotes. This predictive perception approach is the basis of PerceptNote Technology and has already proven useful to central bank decision-makers as they progress design of next generation banknotes.

Using digital images from physical samples, PerceptNote analyses visual information within a banknote by using sophisticated software tools, and then applies knowledge from known human behaviour to predict perception. No people are involved in testing, making this predictive perception solution fast, flexible, confidential, and cost-effective.

With the idea of creating an inexpensive, faster, yet reliable alternative, experts from Secure Perception Research and UnderCurrency worked together to leverage the latest advances in digital image analysis and artificial intelligence (AI). This, combined with UnderCurrency’s engineering wizardry in image capture, led to PerceptNote.

To develop this high-quality technology, the team had numerous obstacles to overcome:

1.To develop a robust method to fully and precisely capture the visual information in new and existing optically variable devices (OVDs) or security features with dynamic effects.

2.To select and apply the best computer vision analysis and artificial intelligence (AI) techniques that would enable predictive perception without jeopardising design confidentiality.

3.To validate the software by directly comparing predictions made by PerceptNote with real human data obtained from actual banknote perception testing.

After years of development, these challenges have been met and now PerceptNote is an accurate, reliable, and well-validated predictive perception tool.

Broadly speaking, PerceptNote involves two main steps. The first involves acquiring precise digital image information; the second focuses on analysing that information.

This technology delivers quantification of two key banknote attributes: (1) how dynamic effects perform for each OVD present on the banknote, and (2) how likely users are to engage with each region or security feature within the banknote. This information is delivered in three forms: (1) visualisation ‘maps’ of the banknote, (2) summarising indices, and (3) textual interpretations.

The starting point for PerceptNote is a full digital representation of the banknotes, or in some applications, the security features, undergoing analysis. Ideally, these are obtained using UnderCurrency’s proprietary Multi-Angle Dynamic Image Scanner (MADIS). MADIS captures images from multiple angles so that a complete, accurate, and high-quality digital representation of all dynamic information on the banknote or sample, including OVD, is obtained. This image capture hardware provides all the data necessary to fully quantify the banknote’s dynamic information available to users when they tilt or manipulate a banknote or sample in any axis.

The rich digital representations obtained using MADIS allow PerceptNote to calculate the mathematical entity representing the entire dynamics within the document. This entity is visualised in a 2D ‘Dynamic Map’ showing the precise location and structure of dynamic image change within each security feature (See Figure 1.) The entity is used, among other purposes, to determine the security feature’s ‘Dynamic Strength’, an objectively-calculated index of the intensity of dynamic image change.

All this information feeds into predictive perception calculations, including quantifying the impact on function and perception of wear and soil on security features. Given that MADIS is operated under standardised lighting conditions, these dynamic measures are suitable for benchmarking banknote or security feature designs and their variants.

Figure 1: Shows the 2D ‘Dynamic Map’ depicting the precise location of dynamic image change within banknote when tilted left to right. Colour refers to the magnitude of change each pixel displays. Dark blue indicates no change, while dark red indicates a significant change.

The critical point here is that PerceptNote operates on digital images. Taking full advantage of the flexibility this brings to predictive perception in the banknote context, this tool offers the very exciting capacity to analyse novel ‘collaged’ banknote designs.

By using sophisticated image manipulation algorithms, PerceptNote can piece together different digitised design elements, including security features with all their dynamic information, to create a novel design. Designs elements can be digitally extracted from different banknotes and then seamlessly pieced together to create new variants. These digitally ‘collaged’ representations can then proceed to the next step of the analyses just like that of any other banknote or sample.

Armed with a digital representation of a novel banknote, PerceptNote’s second step is to analyse all the visual information in the banknote that is used by people during a transaction. As many readers know, the eye and brain do not work like a camera. Whereas the camera uniformly records everything in a scene, our visual system is highly selective. Information that is currently useful gets supercharged attention from the brain and information that is confusing or unnecessary is typically completely ignored. When predicting banknote perception, it is critical to accurately predict which aspects of the banknote are likely to be selected for engagement.

PerceptNotedoes this by mimicking the working of the human brain and, as a result, it accurately predicts the specific design elements that attract and repel attention.

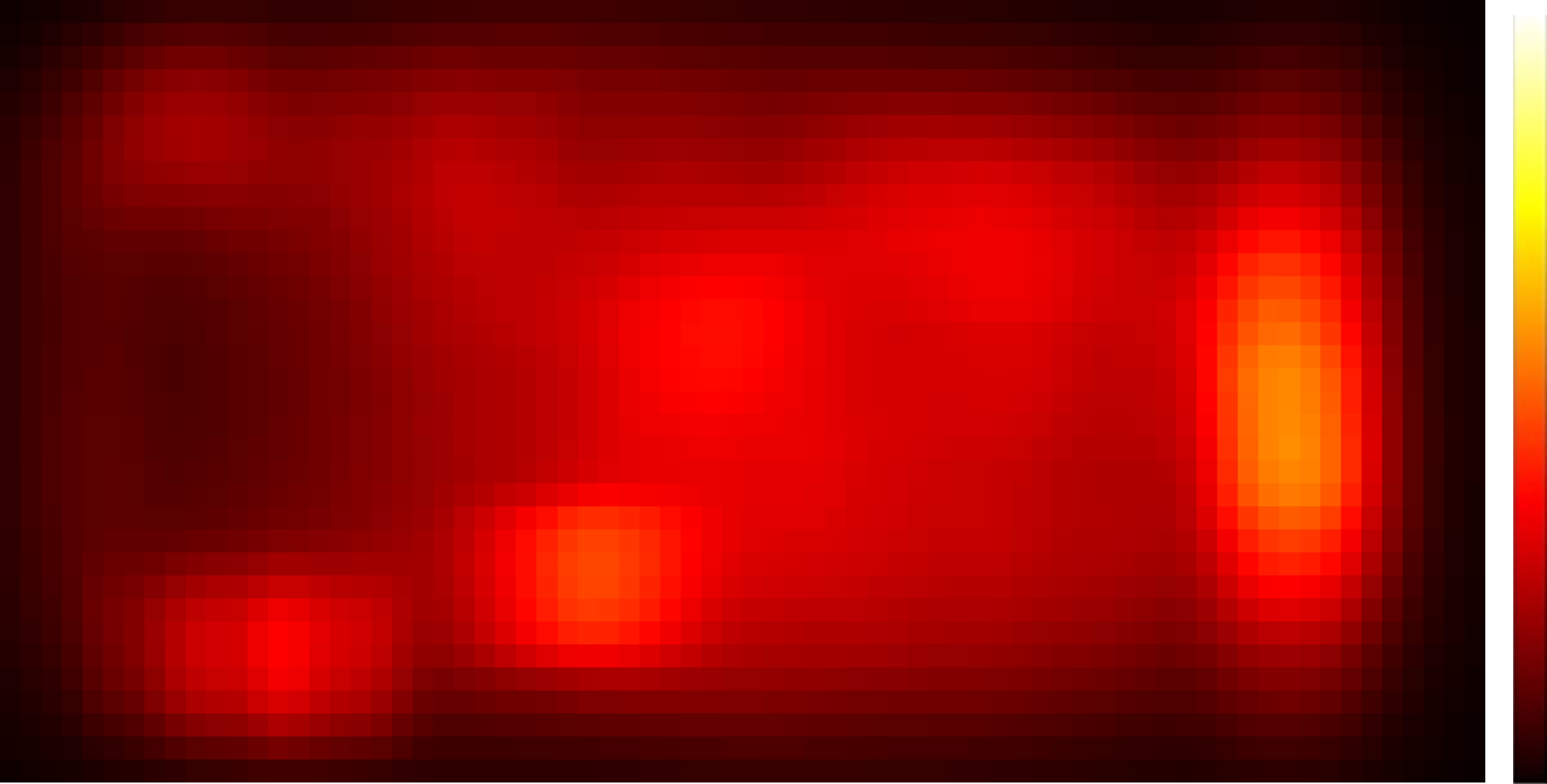

Having analysed a banknote or security feature from this human perspective, PerceptNote delivers an easily interpreted ‘Attention Map’ that highlights the areas on a banknote that public users are most likely to engage with during a transaction. (See Figure 2).

Figure 2: Displays the attention map of the same banknote as in Figure 1, indicating the areas that public users are most likely to engage with during a transaction. Colour refers to the probability of each pixel to attract the attention. Black indicates zero probability, while white indicates a high probability.

High contrast, colour change, movement, depth, or image change are some of the factors that determine these areas of high engagement. However, other ‘cognitive’ factors also determine attentional attraction; these include meaning-related information such as faces, emotional text, and information useful for denomination. PerceptNote weighs up all these factors when determining the Attention Map.

PerceptNote uses the information contained within the Attention Map to calculate sets of sensitive metrics that index perceptual functionality. An especially useful index is the Perceptual Effectiveness Index (PEI). This measure has proven valuable for comparing and ranking multiple design variants and security features effectiveness, and for accurately predicting degradation of banknote perception when banknotes are worn.

Importantly, PEI has been found to be highly correlated with accuracy on authentication tasks in perception testing studies involving public users and real banknotes.

In summary, PerceptNote is a sophisticated technological advance that provides a new way to assess public perception of banknotes. Developed by a collaboration of two leading banknote experts, PerceptNote® is an innovative tool that is easy to apply, focused on the needs of designers and central banks, and offers the big advantage of providing objective results when comparing and benchmarking security features and designs variants.

Prof Jane Raymond is founder and CEO of Secure Perception Research and Professor (Emeritus) of Visual Cognition at the School of Psychology, University of Birmingham, UK. She has pioneered many new perceptual analysis techniques for understanding user perception of banknotes and other high value products and has worked over the last two decades to bring perception science to the banknote industry.

Dr Ernesto González Candela is founder of UnderCurrency, a Mexico-based technical consultancy service comprising a multi-disciplinary team of scientists and other experts and specialising in methodologies and systems for evaluating the security, functionality and durability of banknotes and secure documents.