In last month’s Currency News™, we reported on a new programme for financial inclusion called MoneyBox. In this interview, we provide more detail on this far-sighted and far-reaching initiative.

Banknotes have been used for generations to teach financial concepts and money skills, particularly during childhood. For most of us, physical cash represents our very first interaction with money and early interactions with cash help children develop numeracy and mathematical skills that are essential to responsibly manage our relationship with money in adulthood. Banknotes are a powerful way to explain and demonstrate core money concepts such as earning, spending, saving, borrowing and budgeting.

So says Koenig & Bauer Banknote Solutions, which points to a growing body of recent research clearly showing that the ‘tangibility’ of physical currency makes the value of money more concrete and real for young people when compared to the abstraction or disconnect created when paying digitally.

So what more, it asks, can banknotes do to foster life skills and financial competency development around the planet?

It has set out to provide the answer with its pioneering MoneyBox initiative. We caught up with the creators, Mark Stevenson (MS) & Sina Grebrodt (SG), to find out more about MoneyBox, and how and why banknotes play such a vital role in youth financial competency development.

Mark Stevenson & Sina Grebrodt.

Q: Why did a company who is historically known for supplying banknote printing technology become involved in financial literacy?

MS: As banknote printing technology suppliers, we don’t limit our interest and engagement exclusively to banknote printers or central banks. All of us in the global currency community share a much higher agenda and mission: ‘to support societies worldwide who choose to use cash empower cash-users to build better lives.’ Understanding, using and managing money in a responsible and sustainable way is an integral part of this philosophy.

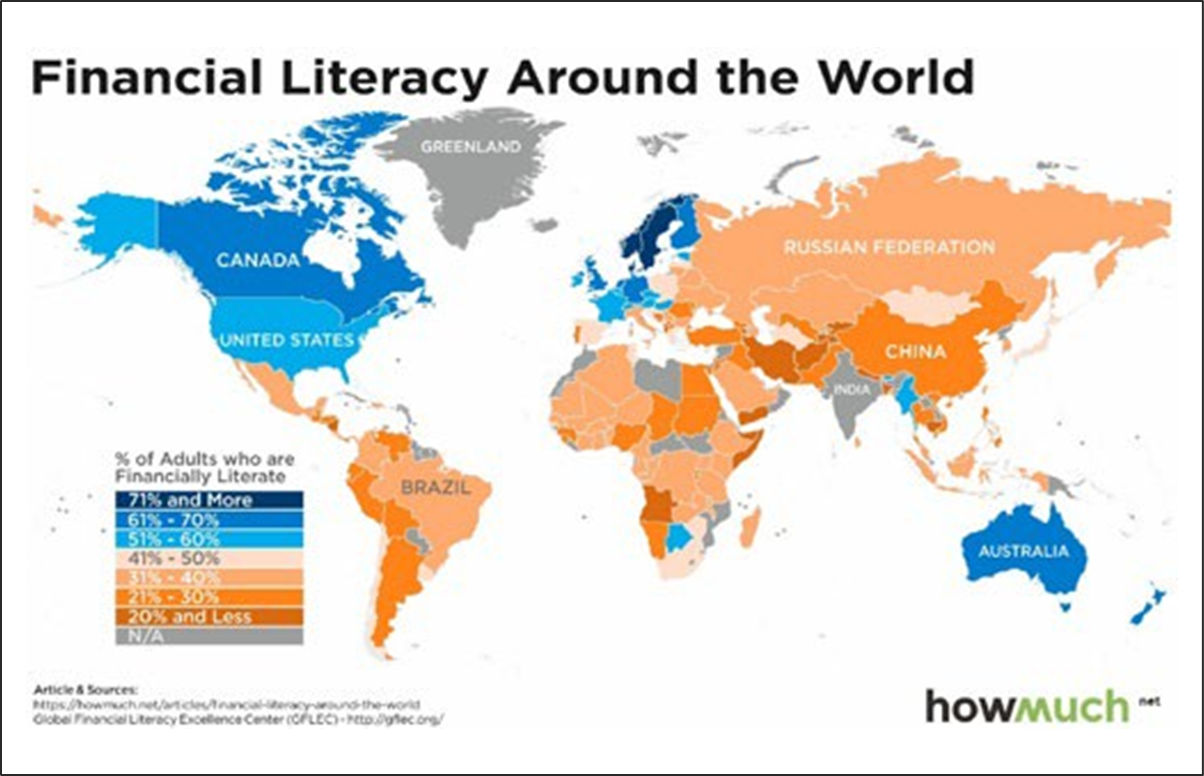

Financial literacy deficits are highest among populations who use and depend upon cash the most – in some countries it’s less than 20%.

But, despite common perceptions, this financial literacy deficit isn’t limited to emerging nations alone. Today, according to the OECD, more than 50% of the world’s population suffer from such deficits and this is equally spread across all countries – emerging and developed. A good example of this is Switzerland, where financial literacy levels have actually decreased since 2020 from 57% to 49% for the youth population.

An incredible opportunity exists to build upon the public’s familiarity with banknotes in all of these nations to transform them into powerful educational vectors. It seems a logical step to support the people who use our product to develop vital life skills, such as financial competencies, so that they can improve their own quality of life and well-being while contributing directly to national socio-economic development.

Q: Should financial literacy be a collective endeavour by the industry, therefore?

SG: First of all, yes – I believe we all share a collective responsibility to make education accessible to all. For many of us, we consider education as the great equaliser, but for far too many people in the world it still remains the great differentiator, and access to basic education still remains a challenge for over one third of the world’s youth population.

Second, as a community, we now have a concrete and practical way to convert words into actions by taking real measures to help cash users around the world. This creates an incredible opportunity for our community to support current and future users of our products – banknotes.

It is hard to imagine any major life decision we make without considering its impact on our finances and money. Money is an incredibly pervasive thing in our lives and it influences our decision-making every day and throughout our entire lives. We simply cannot decouple money from our life journey.

So if we really want to empower populations to enjoy higher levels of prosperity, employment, entrepreneurship, health and social cohesion, we have to support them to develop responsible and sustainable relationships with their money and finances.

Q: When did you start your journey in the financial literacy space and what have you learned since then?

SG: We entered the financial literacy space back in 2023 when we were extremely fortunate to meet our current partner in this field, AFLATOUN International. AFLATOUN is the global leader in youth financial and life skill development, working in over 110 countries through their unique global network of over 350 NGOs, dedicated to this subject.

AFLATOUN quickly immersed us into the world of financial literacy and we were afforded the opportunity to develop a global perspective on the challenges involved but also to engage at grass roots level with the NGOs and spectacular people doing the work on the ground to support youth populations to develop money skills.

A milestone for us was the 2023 Global Financial Literacy Conference in Utrecht, Netherlands. During this event we engaged with central banks, ministers for education and social development, NGOs and big supranational organisations who are committed to addressing the financial literacy challenge on both a national and regional level.

Q: Is there any evidence to show that banknotes actually support the development of financial competencies?

MS: I am so happy you asked me this question. The simple answer is yes… more and more pieces of solid research are appearing on this subject. We now have clear, independent and scientific evidence that demonstrates the unique and irreplaceable role of cash as an essential vector for financial competency development.

In addition, a large body of recent research also demonstrates that the relationship we develop with money at a very young age has a direct impact on our financial habits, attitudes and behaviour as adults. If we fail to develop a sustainable and responsible relationship with money at a young age, it is highly likely that this will have long term adverse impact on us right the way through our lives.

For example, in a recent 2025 German Bundesbank (April Monthly Report 2025 Vol 77 No.4), 94% of the population stated that cash plays a unique and irreplaceable role in the development of child and youth financial competencies.

A Swiss Post Office study from 2025 states that ‘cash is the basis for all financial education… it serves as a tangible basis for children’s first experiences in learning to manage money’. And this is supported by the fact that in a country where almost everyone uses a digital mobile payment tool called TWINT, 73% of parents still believe that physical cash is the best way for children to learn about money.

We have just issued a white paper summarizing the available body of independent research on this subject from around the globe.

It can be downloaded at https://online.flippingbook.com/ view/560671121/

Q: So that’s the background. Can you now tell us what exactly MoneyBox is?

SG: MoneyBox is best described as a banknote-based immersive educational system for financial competency development. It maximises learner engagement and retention while bringing to the forefront the five essential pillars of financial literacy: Earn, Spend, Save, Borrow and Budget.

The MoneyBox System is not just about banknotes. It is an interconnected multi-component system based upon immersive learning through real-life exercises and interplay, as this graphic shows:

The MoneyBox system mirrors the real-life activities that young cash-users encounter every day and focuses on empowering them with the necessary life and social skills to responsibly and sustainably build and manage their own financial future. The interplay of these components creates a one-year, budget-focused learning journey that is simple, engaging, and provides valuable data insights through a dedicated teacher-facing content and support platform.

Q: You said that MoneyBox is not just about banknotes. That it is a learning system. Can you tell us a little about the other components in the MoneyBox System?

SG: There are 12 interconnected components that work together to make the learning journey, engaging, rewarding and impactful. All of these components fuel the data capture process since MoneyBox has been designed and developed by prioritising the importance of capturing user data so that baselining, impact and improvement metrics can be analysed at aggregate or granular levels.

The main MoneyBox components include:

1.Educational banknotes

2.MoneyBox

3.Learning curriculum

4.Teacher-facing app

5.Exercises and games

6.Persona cards

7.Budgeting materials

8.Videos, animations and learning content

9.Learn@home toolkit

10.Data capture and learning analytics system

11.Reward system

12.Certification system.

MoneyBox can be used in any environment where a teacher, educator, leader or parent is present. Different deployment models exist, ranging from integration into national curricula to simply using it at home with family and friends.

Q: What makes the MoneyBox Banknotes so unique?

SG: The MoneyBox banknotes have been designed in collaboration with child education specialists, using cognitive neuroscience-informed design elements to engage and retain the young learners’ attention. The banknote design enables a learning journey independently of whether they are used in connection with the moneybox or simply on their own with parents or family at home, for example.

The front of the banknotes serve as subject-specific reference points that anchor the topic visually, primes core financial concepts and supports quick recognition and recall. This information is used during budgeting and group learner exercises.

The reverse of the banknote is more centred around reflection exercises on the subject of money and creates a life journey where money decisions have a direct impact and quality of life for the individual, family and community.

Parallel narratives are visually programmed into each denomination design, enabling the teacher or parent to address important topics connected with money such as gender equality, employment, climate, sustainability and peace.

Q: What does the learning journey actually look like?

SG: Every learner begins the journey by projecting themselves into the future when asked a key question: ‘How would you like to earn money when you grow up?’ From this point the learner assumes a persona associated with their answer to the question and they follow a life journey that revolves around the five pillars of financial literacy but progressively becomes less abstract and more real as learners receive weekly salaries in cash and must make decisions on how they earn, spend, save, borrow and budget.

As learners develop, they are introduced to a series of real-life shocks and challenges that are highly contextualised to mirror their actual living environment and they must make life-decisions accordingly. A simple example of this may be an unexpected pregnancy, health problems, the opportunity to start a business, or determining the difference between your needs and your wants.

As the learner progresses, they earn micro-credits that can be redeemed against pre-defined rewards…These micro-credits are absolutely essential as they are a reward system to retain young learner attention and engagement throughout the journey.

These micro credits are then converted into a formal recognised certification upon completion of the MoneyBox curriculum, that can be used by young learners to open formal bank or mobile money accounts and gain access to primary financial services.

Q: Who is involved in the MoneyBox project?

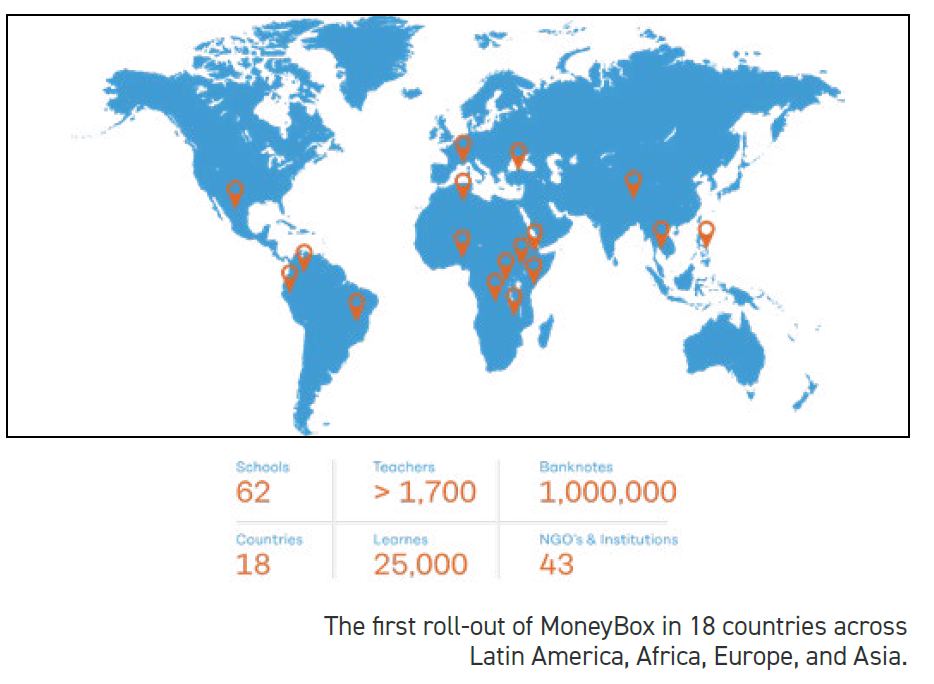

MS: The list is very long… To start with, we have the most important people; the young learners. Almost 25,000 children between the ages of 7-12 living in 18 countries representing a diverse demographic cross-section of society in terms of language, access to education, gender and culture.

Then we have the teachers and educators working in a range of schools and learning clubs who have received training from our partner NGOs in these countries. More than 1,700 teachers are directly involved in MoneyBox and they have a dedicated feedback channel to share their experiences and make suggestions within the MoneyBox community.

MoneyBox has also involved significant consultation and exchange with central banks, ministries for education and social development, finance ministries, and other state institutions who are participating in the project.

And then we have our partner in this endeavour, AFLATOUN International, and their global partner network of over 350 NGOs who has shared their unique expertise, knowledge accumulated over 50 years to make MoneyBox possible.

We are also looking to engage commercial organisations that will support different aspects of the programme. A good example is DHL, who are our global distribution partner for the MoneyBox materials.

The project also involved the design team here at Koenig & Bauer Banknote Solutions, along with our printers and many staff members who freely gave their time took time to pack over 3,000 kilos of MoneyBox materials into more than 100 delivery containers.

Q: How do you plan to make MoneyBox available to nations?

SG: Right now we are prioritising engagement at central bank and Ministry for Education level via accelerated contextualised pilot programmes. This makes it extremely easy and fast to frame the MoneyBox curriculum to fit specific national requirements and address priority challenges such as gender equality, employment or entrepreneurship.

Within a few weeks a national pilot programme can be deployed and executed, providing impact data to the central bank that will enable data-drive decision making on scaling MoneyBox on a national basis, or reaching specific target demographics within society such as rural populations, female populations or underserved communities.

Central banks and education ministries can orientate the MoneyBox curriculum and banknote design to meet current and future national challenges and in this way fast-track impact within highly specific societal contexts.

Q: A year or so ago you launched BeeSmart, a digital learning platform that is also based on banknotes. How does this differ from MoneyBox?

MS: BeeSmart is an all-digital solution and an excellent tool, but it isn’t suitable for many of the target communities because of the lack of digital bandwidth and/or the cost of data in those countries. The physical and tangible nature of the MoneyBox system overcomes the challenges of digital access (that significantly limit learner access) by providing teacher-facing content, such as lesson plans and exercises in either a printed booklet format or a teacherfacing app.

Q: What are your next steps and long-term goals?

MS: Our next steps involve a call to action to the global cash community to become more involved in MoneyBox and support scaling activities by making it more accessible by participating directly in the programme.

We will be engaging with central banks and education ministries, offering them the opportunity to trial a country-specific version of MoneyBox, framed according to their priorities and national strategies. MoneyBox success will be based upon positive impact data and before committing to any large-scale deployment, we invite any central bank to talk with us and simply run a MoneyBox pilot study in their nation and analyse the learning and outcome data.

Our goal for 2026 is to reach 1 million learners and then continue scaling by leveraging international funding and support to reach a goal of 50 million learners by 2050.

This may all seem very ambitious but we are confident…Our community spends over $10 billion dollars every year on producing banknotes for payment and store of value purposes. Imagine if just 1% of this spend was channelled into providing banknotes for educational purposes… This would allow us reach 100 million young people every year, transforming lives and empowering them to build brighter futures.

Now surely that is something we can all aspire to!

Q: How can people find out more about MoneyBox?

SG: It’s really simple… you can contact the people behind MoneyBox at Koenig & Bauer Banknote Solutions directly:

mark.stevenson@koenig-bauer.com

sina.grebrodt@Koenig-bauer.com

Currency News™ and Reconnaissance International are proud to support the MoneyBox initiative and will act as official Media and Event Partner for MoneyBox activities as the project evolves and scales in 2026.

This support starts with the HSP (High Security Printing™) EMEA event next year, which takes place 9-11 February in Rabat, Morocco and where a pre-conference MoneyBox workshop will be held. The workshop will involve representatives from AFLATOUN and KBBS, along with the Moroccan Foundation for Financial Education, Hope for Family Rwanda, and Future Hopes Integrated Family Development of Ethiopia, among others.

The objective is to inspire participants to look at banknotes through an entirely different lens, to re-imagine and redefine exactly what they bring to society, and to encourage all to become part of a global movement.